Services We Offer

Tax Consulting

Tax consulting is a vital service provided by accounting firms, helping individuals and businesses navigate the complexities of tax laws and regulations. With ever-changing legislation, expert tax consultants offer advice on optimal tax strategies, compliance, and planning to minimize liabilities and maximize potential savings. Their knowledge of federal, state, and local tax codes ensures clients can make informed decisions while taking advantage of available deductions and credits. This proactive approach not only streamlines the tax preparation process but also contributes to the overall financial well-being of clients, making tax consulting an essential aspect of comprehensive accounting services.

Notary & LSA Training

Notary and loan signing agent training is an essential component for accounting firms looking to enhance their service offerings. By equipping staff with the skills necessary to become certified notaries and loan signing agents, firms can streamline document processing and provide clients with seamless, professional services. This training covers crucial topics such as acknowledging signatures, understanding loan documents, and adhering to state regulations, ensuring that participants are well-prepared to handle important financial transactions with accuracy and confidence. Investing in this training not only strengthens the firm's capabilities but also demonstrates a commitment to providing comprehensive support for clients navigating complex financial processes.

Federal Tax Preparation

At our accounting firm, we understand that federal tax filing can be a complex and daunting process for many individuals and businesses. Our team of experienced professionals is here to guide you through every step, ensuring compliance with the latest IRS regulations while maximizing your deductions and credits. We offer personalized tax planning strategies tailored to your unique financial situation, so you can minimize your tax liability and achieve your financial goals. Trust us to handle your federal tax filing with accuracy and efficiency, allowing you to focus on what matters most to you.

Corporate Tax Filing

Corporate tax filing is a crucial aspect of financial management for businesses, and an experienced accounting firm can provide invaluable assistance in navigating the complexities of tax regulations. With ever-changing tax laws and regulations, it's essential for corporations to ensure compliance while maximizing their tax efficiency. Accounting firms offer a range of services, including preparing and filing returns, tax planning, and advisory services tailored to meet the unique needs of each client. By partnering with a knowledgeable accounting firm, corporations can not only streamline their tax filing process but also identify potential deductions and credits, ultimately reducing their tax liabilities and improving their bottom line.

Tax Planning

Tax planning is a crucial service offered by accounting firms, aimed at helping individuals and businesses minimize their tax liabilities while ensuring compliance with current tax laws. By strategically analyzing financial situations, accountants can recommend tailored solutions that optimize deductions, credits, and overall tax strategies. With expert guidance, clients can navigate complex tax regulations, take advantage of available incentives, and make informed decisions throughout the year. Effective tax planning not only mitigates the risk of audits but also contributes to long-term financial stability and growth. Partnering with a knowledgeable accounting firm empowers clients to proactively manage their tax obligations and achieve their financial goals.

Tax Preparation Training Classes

As the tax season approaches, our accounting firm is excited to offer specialized tax training for new preparers. This comprehensive program is designed to equip novices with the essential skills and knowledge needed to navigate the complexities of tax preparation. Participants will learn about the latest tax regulations, filing techniques, and client communication strategies, all under the guidance of our experienced professionals. This training not only enhances their technical abilities but also fosters confidence, ensuring they are well-prepared to assist clients effectively. Join us as we embark on this invaluable learning journey to lay a solid foundation for your career in tax preparation.

Financial Statement Preparation

Financial statement preparation is a critical service offered by accounting firms, ensuring that businesses maintain accurate and compliant records of their financial activities. This process involves compiling comprehensive reports, such as balance sheets, income statements, and cash flow statements, which reflect the company's financial position and performance over a specific period. By leveraging their expertise, accounting professionals ensure that these statements adhere to generally accepted accounting principles (GAAP) and provide valuable insights for stakeholders, including management, investors, and regulatory bodies. Accurate financial statements are essential not only for effective decision-making but also for maintaining transparency and building trust with clients and investors alike.

IRS Audit Representation

When facing an IRS audit, having experienced audit representation can make a significant difference in the outcome of your case. An accounting firm specializing in IRS audit representation provides clients with knowledgeable professionals who understand the complexities of tax laws and IRS procedures. These experts can help prepare necessary documentation, communicate directly with the IRS on your behalf, and develop effective strategies to resolve discrepancies. With their guidance, you can navigate the audit process with confidence, ensuring your rights are protected and aiming for the best possible resolution to your tax situation.

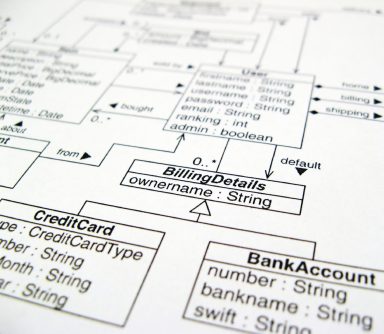

Business Formation Services

At our accounting firm, we specialize in providing comprehensive business formation services tailored to meet your entrepreneurial needs. Our knowledgeable team will guide you through the entire process, ensuring that your business is compliant from the start. We handle all necessary filings with the Secretary of State, managing the paperwork required to legally establish your entity. Additionally, we assist in obtaining your Employer Identification Number (EIN), which is essential for tax purposes and hiring employees. With our expert support, you can focus on launching and growing your business while we take care of the foundational aspects.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.